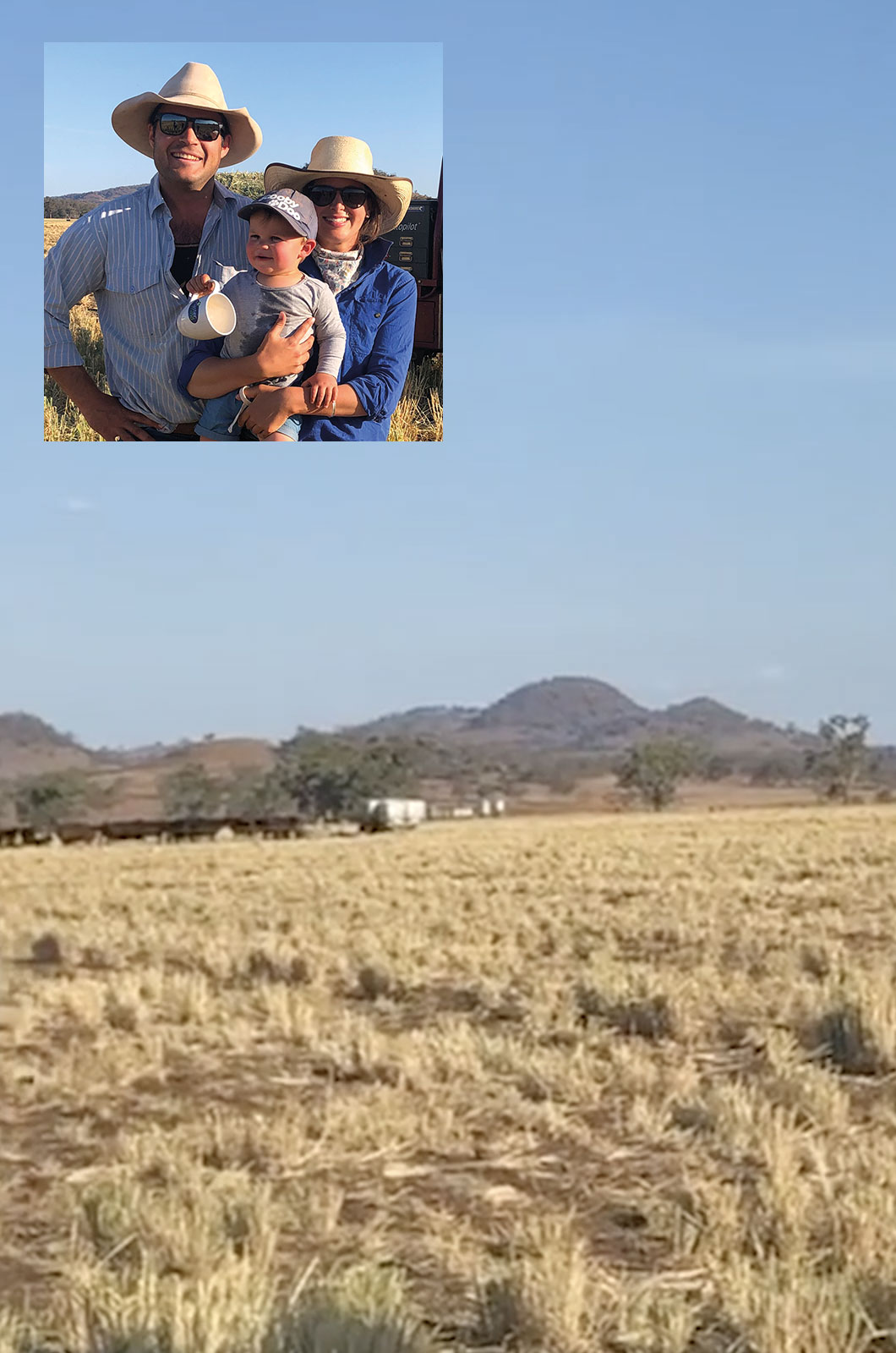

Location: Spicers Creek, NSW

Location: Spicers Creek, NSW

Owners: the Mason family

Nick and Mary Mason and their son, Matt and his wife Kellie, have a mixed farming property at Spicers Creek near Wellington in NSW. In addition to Nick and Matt, they employ one full-time and one part-time staff member.

The enterprises

Nick explains that prioritising the three enterprises is a tool for decision making in dry times. For example, their priority is:

- sheep: prime lamb and wool

- crops

- cattle.

Sheep. The prime lambs are from first-cross Merino ewes and Poll Dorset rams. The breeding stock are bought-in from carefully selected properties. The award-winning lambs are the most profitable part of the farming operation. The high quality is exemplified by winning the championship in the Prime Lamb Hoof and Hook competition at the Dubbo Show. The lambs are usually sold at auction at approximately 42 kg liveweight and are sometimes sold over the hooks (usually on request from an abattoir).

The sheep are not the first animals destocked in dry times but if needed, they will be culled hard. The old ewes are sold first, followed by the lambs. If the lambs are under the desired weight, careful consideration is given to the cost of feeding them to heavy export stage compared to loss of income by selling early.

Crops and pasture. Wheat, canola, oats, and barley are sown when soil moisture is adequate. The crops are used for both grazing and grain. The practice is to store enough silage, hay and grain to feed all stock for full drought ration for twelve months. A paddock is cropped for three years and then put down to pasture that includes legumes for another seven years. About 30 per cent of the land is farmed and about ten per cent put down to new pasture each year.

Cattle. Store steers are bought and finished on the pastures. If pasture is unlikely to support more cattle, no new ones are bought-in. Stock numbers are matched to pasture available but not to maximum available. It is important to protect the pasture and maintain ground cover.

Fiscal opportunities

Nick advises producers to use opportunities that allow them to prepare for drought years when cashflow is low or non-existent.

The Farm Management Deposits (FMD) scheme helps primary producers to deal more effectively with uneven income flows. It gives concessional tax treatment to deposits made during years of good cash flow, which can then be drawn on in later years when the funds are needed.

FMD accounts are commercial products offered by financial institutions. The Department of Agriculture, Water and the Environment has policy responsibility for the scheme. The ATO is responsible for the administration of the tax aspects of the scheme.

Generally, deposits you make into an FMD account are tax deductible if certain conditions are met. When you withdraw deposits that you previously claimed as a tax deduction, that amount is assessable income in the year it is repaid to you.

Accelerated depreciation for primary producers allowsexpenditure on capital works to be 100 per cent tax deductible in the year of expenditure. This allows you to build water infrastructure or other measures that can help manage a drought when you have a good year and then deduct the cost from taxable income for that year.

Typical allowable expenditure includes:

- the cost of fencing and water facilities such as dams, tanks, bores, irrigation channels, pumps, water towers and windmills

- depreciation over three years of the cost of fodder storage assets such as silos and tanks used to store grain and other animal feed.

- Under previous arrangements, primary producers can claim a deduction for the decline in value of:

- fences over a period up to 30 years

- water facilities over three years

- fodder storage assets over a period up to 50 years.

- For more information contact your rural financial counselling or advisory service.

Nick’s words of advice:

- be conservative on your stocking rate

- maintain ground cover

- protect your pasture.

Tocal newsletter

Want to find out about news, events, courses and publications?