Type: Online

Units: 6

Type: Online

Units: 6

GROW - Generating Regionally Outstanding Women

A professional development program for women in the NSW farming businesses.

This course has been delivered for both young and experienced farmers and advisers, with excellent feedback on content, ease of learning and learning outcomes. Go beyond traditional learning styles by using your own farm data and ignite your learning of farm business management.

Designed by highly experienced agribusiness professional and author Mike Krause (P2PAgri), the course is delivered by Mike and Tony Hudson, an experienced agribusiness adviser and past Director of Farm Business Management at Marcus Oldham College. The course will teach you how to:

| Course duration: | 12 weeks: 5 interactive Zoom sessions (2 to 3 hours in duration) PLUS 5 individual (confidential) Zoom sessions with your coach (Mike or Tony) |

| Start date: | Multiple intakes |

| Number of units: | 3 |

| Indicative fees: | Nil to eligible applicants $2,970 per person for those that are not eligible for funding. |

| Accredited Course: | Yes |

| AgSkilled: | Yes |

This course has been made possible through funding from the NSW Government’s AgSkilled™ program.

This training is being conducted by experienced agribusiness trainers:

Mike Krause

One of Australia’s most experienced agribusiness professionals, Mike Krause has 40 years’ experience in farm financial modelling, sensitivity analysis, farmer agri-business training, farm business consulting, and agricultural risk management. He is owner of P2PAgri and is a published author in farm business management. One of his books ‘Farming the Business’ (published by GRDC) is going to its 5th printing in 6 years and forms the text for this course.

Tony Hudson

A passionate member of the agricultural business community, Tony is committed to helping rural businesses improve their profitability, resilience, and overall business performance. Tony has been Director of Farm Business Management at Marcus Oldham College (Geelong) and now manages his own farm management consulting company, Hudson Facilitation. He is also the senior trainer in farm finance for the Rabobank Financial Skills course run by the Rabobank’s Client Council.

The online course aims to develop knowledge and skills to:

$2,970 per person for those that are not eligible for funding.

The course duration is 12 weeks with the following structure:

Week 1 | Mail out of books and getting you started online |

Week 2 | Group interactive Zoom session 1 – Weekday 9am to 12pm (3 hours) |

Week 3 | Individual Zoom one-hour coaching session with your trainer (1 hour) |

Week 4 | Group interactive Zoom session 2 – Weekday 9am to 11am (2 hours) |

Week 5 | Individual Zoom one-hour coaching session with your trainer (1 hour) |

Week 6 | Group interactive Zoom session 3 – Weekday 9am to 12pm (3 hours) |

Week 7 | Individual Zoom one-hour coaching session with your trainer (1 hour) |

Week 8 | Group interactive Zoom session 4 – Weekday 9am to 12pm (2 hours) |

Week 9 | Individual Zoom one-hour coaching session with your trainer (1 hour) |

Week 10 | Group interactive Zoom session 5 – Weekday 9am to 12pm (2 hours) |

Week 11 | Individual Zoom one-hour coaching session with your trainer (1 hour) |

Week 12 | Wrap up and submission of any remaining assessments |

To enable you to get the most out of your training experience, you will need to commit to completing approximately four hours homework each week in addition to the group and individual zoom sessions.

For this course we are using Zoom, a virtual classroom through your computer. Don’t worry if you haven’t used this before as many previous participants hadn’t, and they really enjoyed the convenience! We are using Zoom for both group sessions and one-to-one sessions.

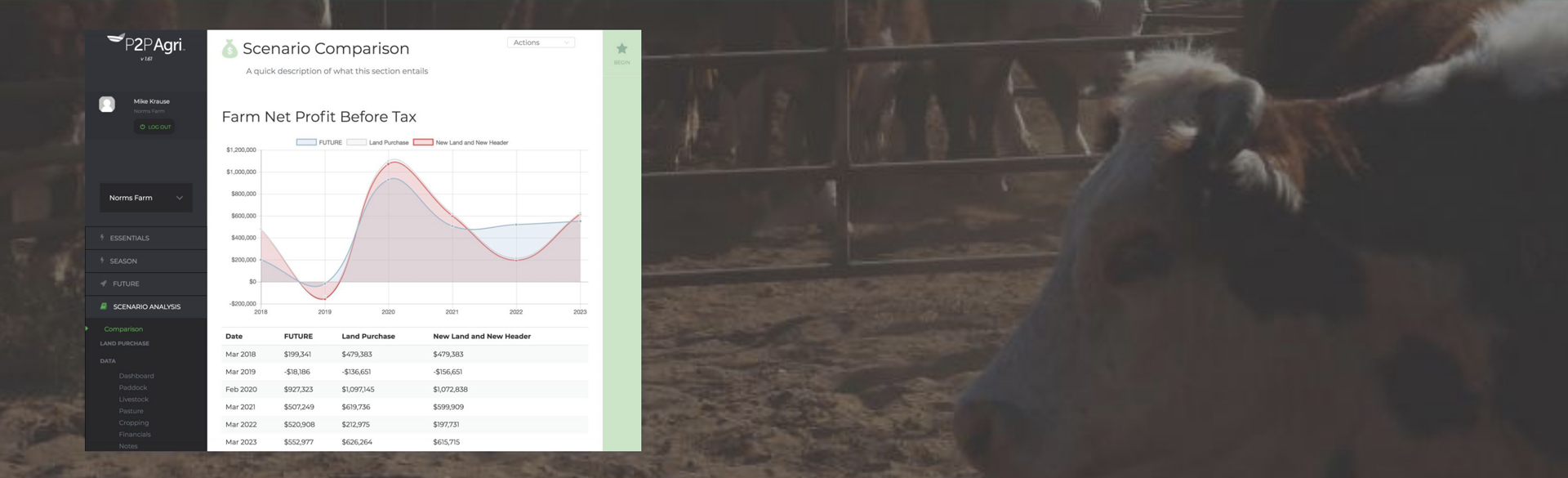

We will also be using P2PAgri (Plan2Profit Agri), easy to use and innovative cloud-based software.

We recommend everyone on your farm management team!

You must have prior experience in financial transactions and budgeting.

NB: This is not an entry level course.

Absolutely! It’s very important you learn using your own business information - this information will remain in strict confidence between yourself and your trainer.

This course is aligned to the following national units of competency:

Q1. How much study is involved?

To enable you to get the most out of your training experience, you will need to commit to completing approximately 4 hours of homework each week in addition to the group and individual zoom sessions.

Q2. What happens if I cannot attend the Group Zoom?

All Group Zoom sessions are recorded and are posted in the course on the same day.

If you miss a Group Zoom you will need to listen to the recording before your scheduled 1:1 Zoom coaching session. Your trainer may postpone your 1:1 if you have not listened to the recording.

Q3. What happens if I cannot attend a 1:1 Zoom coaching session?

The 1:1 Zoom sessions are private coaching sessions to improve your skills and have your specific questions answered. If you are unable to attend a 1:1 session please let your trainer know as soon as possible.

As the course only goes for 12 weeks there is limited opportunity to reschedule missed sessions.

Your trainer will do what they can, but it may not always be possible to fit you in.

Q4. How do I get the best out of my 1:1 coaching session?

PREPARE for each session by developing a list of questions you need answers to prior to the session.

Look ahead at assessment tasks - if there is anything you are not sure of add this to your list of questions.

Use your coaching sessions to answer any assessment queries you may have.

Q5. Are the 1:1 coaching session recorded?

To ensure your privacy they are not recorded.

Q6. Do I have to use P2PAgri Software?

The short answer is yes. We understand you may already be using agribusiness software.

For the course, you will need to use P2PAgri software.

‘You are also able to cancel at any time by logging into your P2PAgri. If you wish to cancel your P2PAgri subscription, log in and go to Settings > Subscription and click on the orange Cancel button. If you haven’t cancelled by the end of your course, P2PAgri assumes you wish to continue and use this powerful software.

The licence fee enables you to continue to receive P2PAgri support.’

Q7. How long will I have access to the P2PAgri software?

You will have 'free' access to the software for the duration of your course (12 weeks).

After this, you can continue with the software as a licensed user - fees apply.

You need to opt out of the subscription at the end of the course – see question 6.

Q8. Is it possible to extract my data from P2PAgri at the end of the course?

You can extract data via the PDF report function. You can also export a CSV file of your cash flow budgets.

Lastly, you can take screenshots of any data/information you want to retain after the course.

Q9. What do the assessments involve?

During the course, you will use P2PAgri as a data entry and business planning tool.

This includes developing Profit and Loss Statements, Balance Sheets, budgets and a five (5) year plan. Assessment tasks 1, 3, 4 and 5 involve submitting a range of financial reports using the PDF reporting capability of the software. It does the hard work for you!

Assessment task 2 is a series of short answer questions to help you start the business planning process. Handwritten submissions for this task are okay, as long as we can read your writing!

You can have up to three (3) attempts at each assessment task.

Feedback will be provided on each assessment submission.

Q10. What happens if I miss the assessment due dates?

Plan to meet the assessment task due dates as they are designed as learning building blocks.

If something happens to prevent this, let your trainer know ASAP.

There is a little fat in the program; however, you do need to submit all tasks by Week 11 at the latest.

An assessment criterion is your ability to forward documentation in a timely and efficient manner – this will be measured through meeting the assessment submission timelines of the course.

Q11. How do I set up my user profile in the P2PAgri software?

Instructions will be provided by Tocal in your enrolment emails.

Q12. Tell me more about P2PAgri software

Watch Mike's video to get an overview of the software.

https://www.youtube.com/watch?v=-JljY5vDHVg&t=3s

Q13. Which trainer will I get?

You will get either Mike Kraus, Tony Hudson, or Peter Hudson for your course delivery.

Q14. Who will be marking my assessments?

James McRae a trainer and assessor for the Tocal online Diploma of Agriculture will be marking your assessments.

Absolutely! It’s very important you learn using your own business information - this information will remain in strict confidence between yourself and your trainer.

For information on students rights and responsibilities, and the Tocal College Code of Practice see Student policies.

Want to find out about news, events, courses and publications?